Greetings,

I am pleased to introduce our masterpiece generating high returns with Money Lender Partners and protecting principal loss with the Insurance Partner called “Mortgage Care Loan Investment”. This program was created by Incutek and our valued Partner, P2P Asset Management.

USD 200 million was made and collected without a default since P2P Asset Management invented this program 3 years ago. Many capital and P2P companies enjoyed this program until August 2020 when the Korean government strengthened restrictions on mortgage loans.

A well-known Insurance company, 2 Money lenders, NPL company, P2P Asset Management and incutek made contracts to launch this new “Mortgage Care Loan Program

I strongly recommend this opportunity as a great alternative to fixed income.

USD 200 million was made and collected without a default since P2P Asset Management invented this program 3 years ago. Many capital and P2P companies enjoyed this program until August 2020 when the Korean government strengthened restrictions on mortgage loans.

A well-known Insurance company, 2 Money lenders, NPL company, P2P Asset Management and incutek made contracts to launch this new “Mortgage Care Loan Program

I strongly recommend this opportunity as a great alternative to fixed income.

Partner

- Terms of Loan

- Interest Rate

Above terms subject to change without prior notice reflecting market conditions.

Iterest is subject to around 10% ~ 15% withholding tax according to tax treaty between Korea and investors' country.

※ Subject to Change without prior notice

- Maturuty

1 Year (Revolving if agreed)

- Collateral

Lien on Mortgage Loan (Condominium)

- Location of the Condominium

Seoul, Kyunggi, Inchon

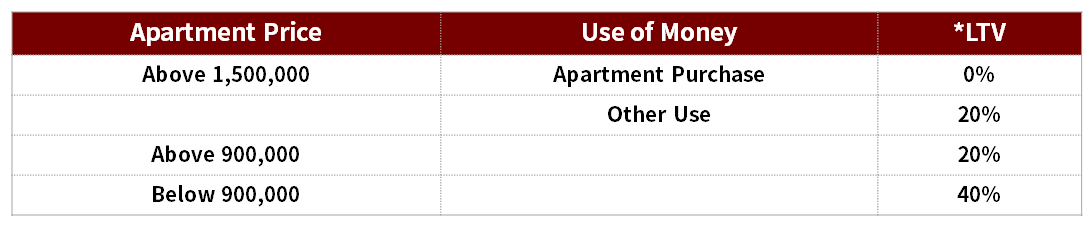

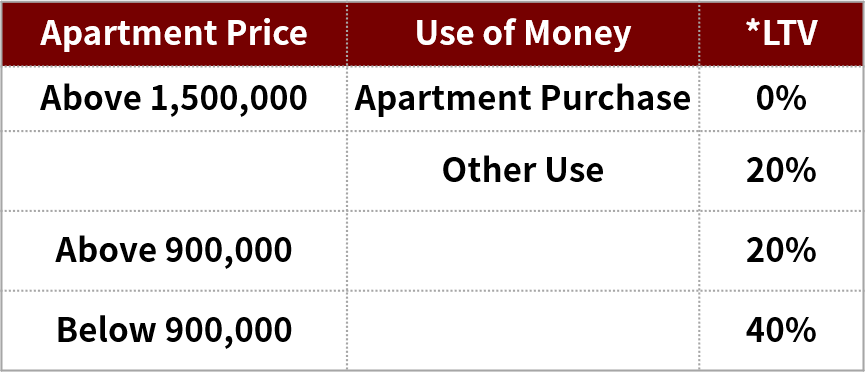

- 85% LTV Limit based on KB Bank’s Condominium Price.

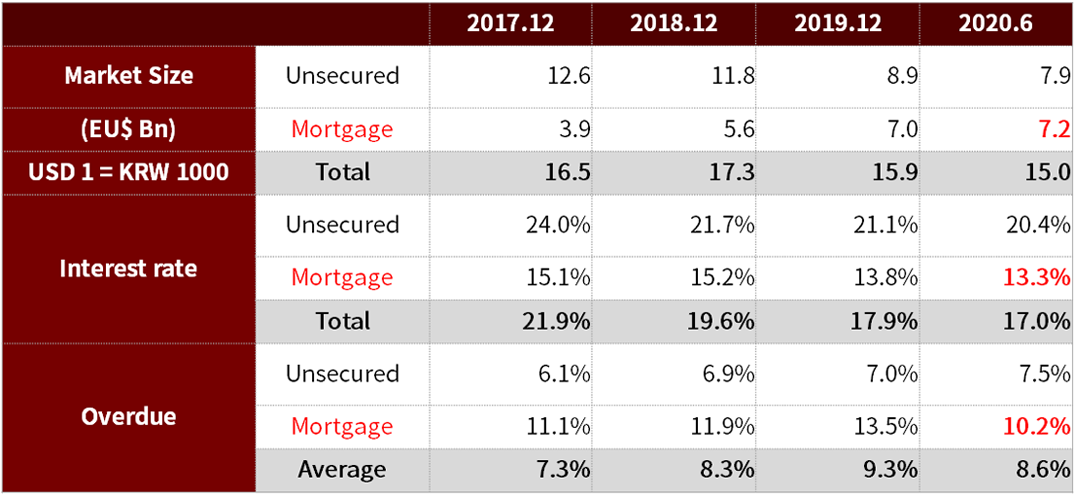

- Mortgage Loan Maket Opportunity

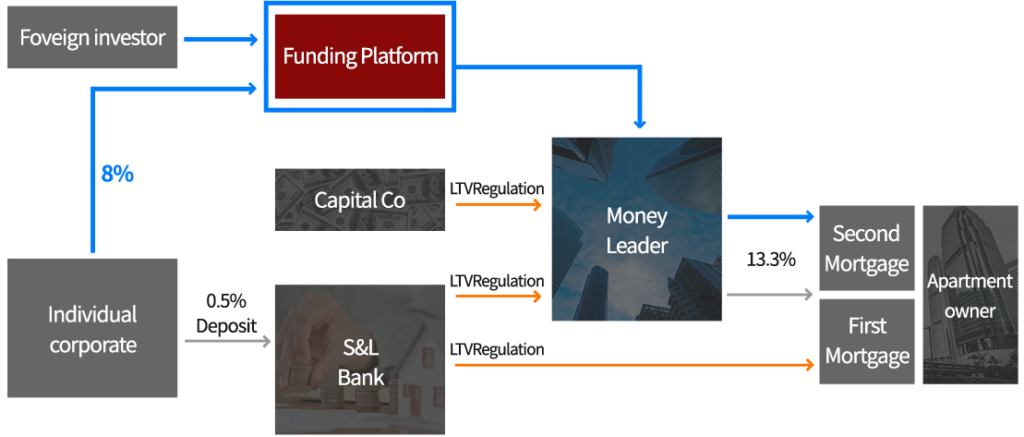

- Korean Government LTV Regulations

LTV for Seoul, many parts of Inchon and Kyunggi region

- Regulation Created High Return Opportunity

- Korean Money Lenders’ Market

Source: Financial Supervisory Service 2020.12

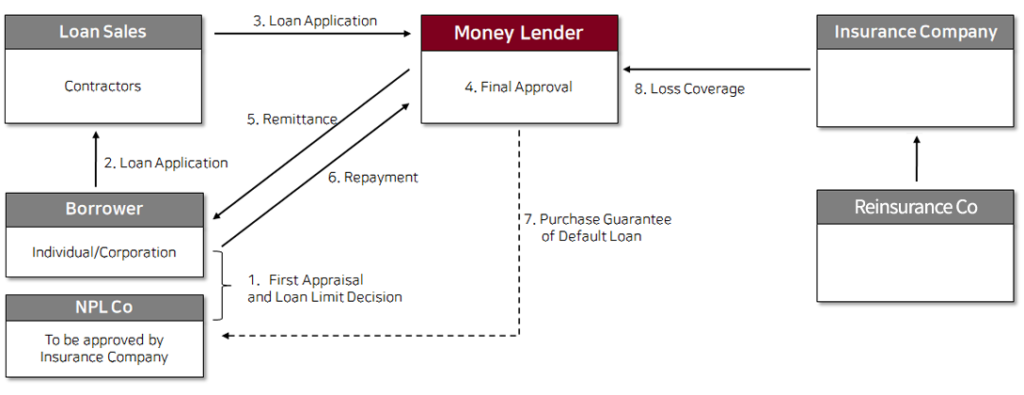

- Transaction Structure

Investor will hold Condominium asset risk by executing 1~6 contracts simultaneously.

- Investor’s money will only be used for Condominium loans.

- Investors hold lien and insurance at the time of investment.

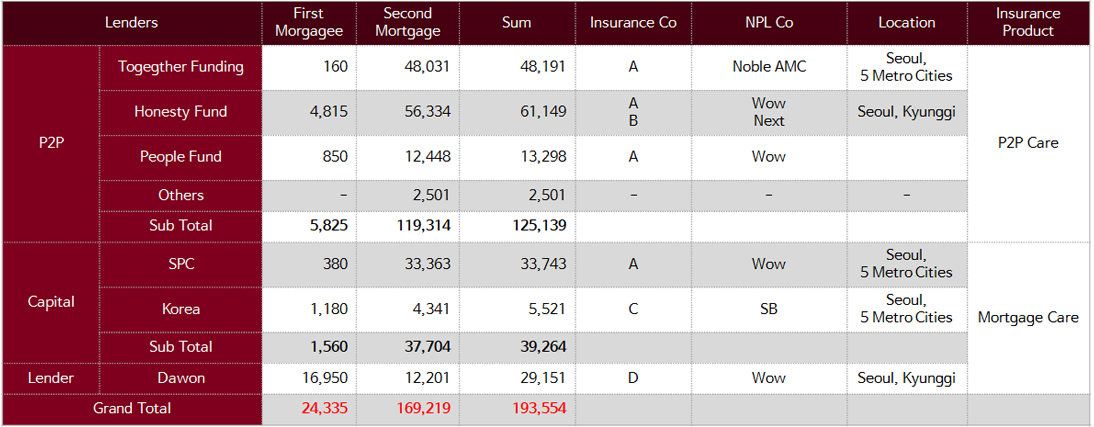

- Loans under mortgage care insurance during last 2 years

P2P and capital companies enjoyed mortgage care loans but new regulations in August 2020 virtually prohibited these loans.

Total amount of Loan

EUSD 200 million without a Single Default

EUSD 200 million

without a Single Default

without a Single Default

(as of end of November 2020)

[Unit: USD thousand]

- Security of Loan

Investment Proceed is only for Condominium Loan, Loan execution after receiving Lien and Insurance

- Loan is exposed to risk if the

Condominium price drops more than 15% within a year.

- Korean government will take measures to support the real estate market when the price declines.

NPL Company try to minimize LTV during the loan approval process to minimize purchase guarantee risk.

- Foreclosure process starts if NPL can not buy default loan.

- Insurance cover the loss when the final auction price is lower than the loan principal.

- What is Mortgage Care Insurance?

- Mortgage care insurance covers following loss during insurance period

Loan is in default : Loan principal and/or interest payment is delayed more than 60 days.

NPL company can not perform default loan purchase guarantee due to defualt, court receivership and other irresistible forces.

The Named Insured (borrower) take best efforts to find other NPL companies to sell the default loan without success,

Then the Named Insured put the loan into foreclosure process. If the final auction price is lower than the Assured Value,

The shortage amount (= Incurred loss) shall be paid according to the Insurance Agreement.

- Covered Property

Residential Condominium with more than 50 households

- Limit of Liability

upto 85% of appraisal price

- Insurance & Reinsurance Company

- Mortgage Loan Process for Condominium Buyers